Research Background

Extensive time and budget are invested in the production and placement of TV Spots. The scale of exposure and reach of shareability in the digital age means brand perceptions are now more vulnerable than ever. To alleviate these concerns it is prudent to conduct creative testing to uncover people’s non-conscious sentiment towards a given creative in order to optimise before go-live.

AIG, a multinational insurance provider with a strong presence in the Irish market, were launching a TV spot to promote their “Young Drivers Insurance” towards young adult drivers across the country. A TV Spot was produced for the campaign and a post-production research study was executed to carry out an evaluation of the creative.

Research Question:

Evaluate the subconscious impact of the creative on the viewer and how has exposure to the creative impacted the viewer’s ability for recall & purchase propensity when compared with a selection of alternatives (e.g. competitors)?

Research Approach:

The scope of the analyses contained a selection of topics and angles which are listed below:

- Emotional Evaluation: Critical and comparative analysis of the stimulus through the lens of Arousal (Galvanic Skin Response), Displayed Emotion (Facial Expression Analysis), Attention (Eye-Tracking) and Self-Reported rational thought.

- Implicit Preference: Uncovering the implicit (automatic) preferences of the respondents towards the creative and understanding how that correlates with self-reported recall or purchase propensity.

- Aided & Unaided Recall Testing: Testing of the respondent’s ability to recall the brand in question post-exposure to the stimuli

- Purchase Propensity: Collection of the self-reported propensity to purchase post-exposure to the stimulus.

Testing Approach

The carousel below depicts the different biometric testing approaches and the rationale for their applicability of this research:

Study Design

Respondent Overview:

For a thorough analysis, a body of respondents was selected that were representative of the target market: 31 young adult drivers aged 19-27, seeking a cost-effective option for car insurance.

Setup & Calibration:

- Participants were fitted with a wrist-based GSR device

- The webcam was enabled to support Facial Coding / Facial Expression Analysis

- The Eye-Tracker was calibrated before launching any tests

- All Survey based questionnaires are built into the study journey & managed as part of the testing experience

Testing Experience

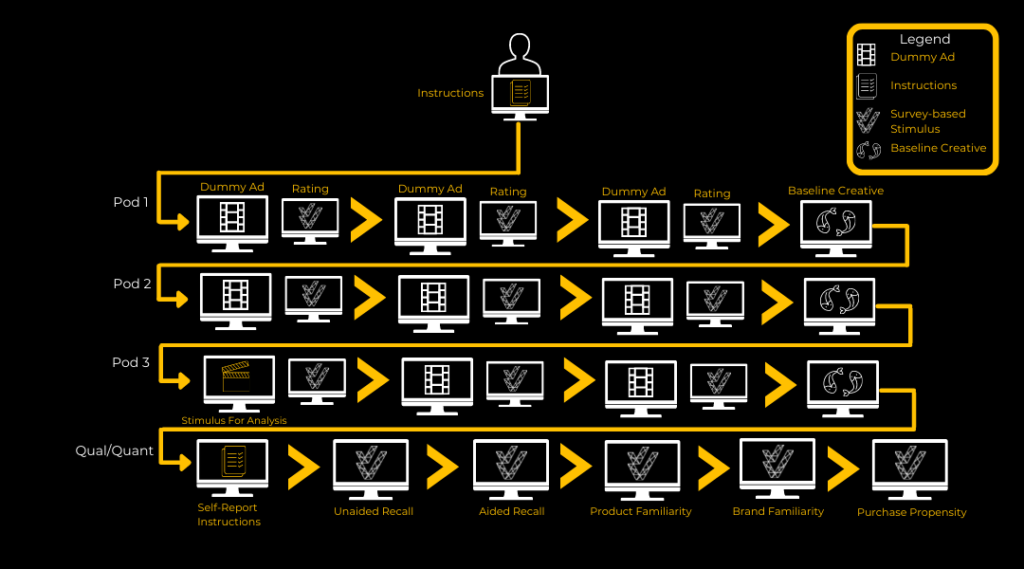

The process was segregated into three ‘Ad Pods’ and a self-report section containing qualitative & quantitative questions pertaining to the ads.

Key Takeaways

- A Steadily Engaged Audience

Respondents were found to have a consistent level of emotional arousal throughout the exposure, indicating a high level of viewer engagement throughout.

- Moderate But Consistent Emotions

The AIG creative demonstrated a consistent level of moderately charged emotions throughout the exposure, which ultimately supported the respondents recall abilities.

- Opportunity Missed to Create Brand Associations at Brand Reveal

When compared with the other creatives in question, the final branding scene performs relatively well, however the final branding moment doesn’t exhibit a discernible emotional peak from which consumers form brand associations.

- Minimalist Design Holds Attention

The simplicity and intimate design of the creative allows for additional focus on the face which reinforces attention to the message being delivered by the actors.

- Paralysis By Analysis

The volume of close screen elements, creates an overload on the viewer where brand, product & messaging items such as Call-to-Action & a discounted offer are all competing with one another for the viewer’s attention. This approach results in divided fixation duration and reduced cognitive processing, ultimately impacting propensity for recall.

- Diminishing Attentiveness at End Card

There was a notable diminishing level of attentiveness towards key Areas of Interest at the very end of the creative, this can be attributed to the duration of the closing end card.

- Memorability & Purchase Propensity

61% of respondents were able to recall the AIG brand post-exposure, with AIG being the first preference for 23%. With 54% of respondents indicating that they would be likely to purchase Young Driver Insurance from AIG in the future post-viewing the advertisement. - Uncovering Rational Thought

There was a high-correlation between the subconscious emotional response of the AIG creative in terms of Arousal, Attentiveness & Displayed Emotion with the Self-Reported outcomes with respect to Aided / Unaided Recall and Purchase Propensity.

Detailed Findings

The results and findings produced an interesting summary of analysis based on the aggregated emotional response of the data set.

A Steadily Engaged Audience

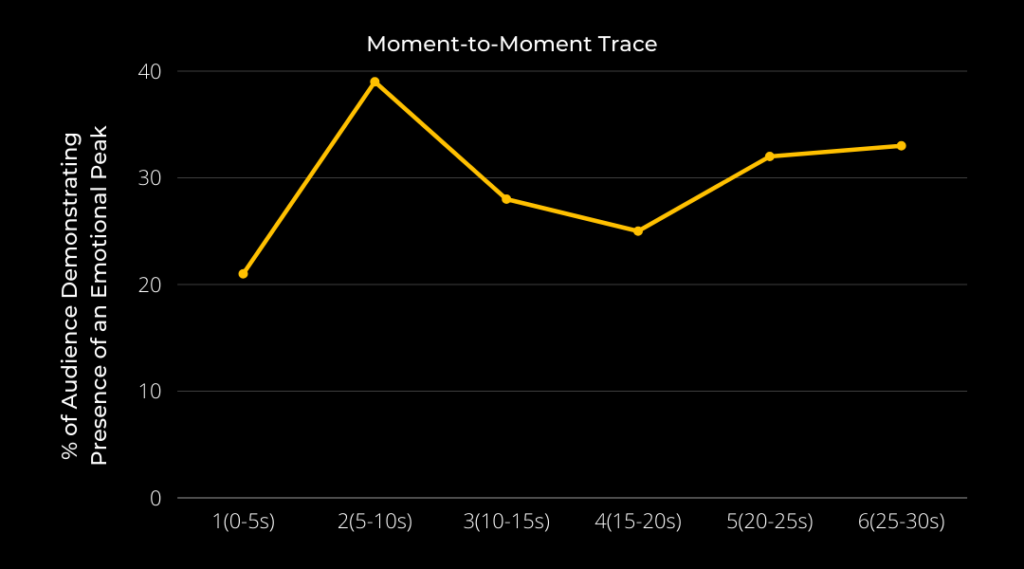

Moment-to-Moment Analysis (M2M) maps out the emotional journey of the body of respondents throughout the exposure.

- Viewers simultaneously experienced a steady level of emotional arousal throughout the entire exposure, this would indicate a high level of engagement throughout.

- On average at least 30% of viewers were experiencing an emotional response at any point during the exposure, indicating a moderate-high level of engagement with the piece. Ultimately increasing the propensity for recall.

- This level of engagement can be attributed to the intimate pacing, design & narrative of the creative, where the actors are speaking in a direct, relatable and slow-paced fashion to the viewer. This approach runs the risk of fatiguing the viewer, however through the use of nostalgia and tapping into pre-existing associations from other driving campaigns & real-life experiences of the audience (e.g. ”never, ever drinking & driving“, “arriving alive”, “theory tests” etc.) maintains the viewer’s engagement from an emotional perspective throughout.

Moderate But Consistent Emotions

AIG’s BoxClever creative managed to elicit a consistent volume of mid-range emotional peaks without driving any highly arousing emotions or any long emotional responses when compared with the other creatives under observation.

- Peaks Per Min: The BoxClever creative received 2nd highest Peaks per/minute (3.41) of all creatives under observation. This in combination with the below points would strongly indicate that the BoxClever creative was particularly efficient in driving a consistent volume of moderate emotional peaks throughout the creative, ultimately supporting recall ability.

- Peak Amplitude: AIG’s BoxClever produced the 3rd lowest Emotional Peak of all creatives under observation. Strong Emotional peaks help drive associations within the viewer’s mind where they associate the product/brand with the experienced emotion (e.g. Coca Cola association with joy). High Emotional peaks are particularly powerful at the point of Logo Reveal where we provide room for consumers to associate this strong emotion to the brand, which leaves opportunity for optimisation. We as humans show a cognitive bias towards the emotional peak and the end of an experience also known as the Peak-End Effect (e.g. think of movies like The 6th Sense or The Usual Suspects) thinking through this lens also leaves opportunities for optimisation going forward where we might target an increased peak amplitude (stronger & longer emotion) which would help drive average peak duration (below).

- Average Peak Duration: Stronger peaks last longer, as such the BoxClever creative generated the shortest average peak duration, which would align with the fact that the creative was able to generate moderate responses consistently instead of any single standout or longer lasting emotive moments.

GSR Report:

| Brand | Commercial Duration (sec) | Peaks Per Min | Total Peak Count | Highest Peak Amplitude | Avg.Peak Duration (ms) |

|---|---|---|---|---|---|

| Brand A | 54 | 3.29 | 89 | 0.4727 | 2,872 |

| Brand B | 53 | 3.14 | 80 | 0.5309 | 2,858 |

| Brand C | 60 | 3.61 | 108 | 0.6279 | 2,899 |

| Brand D | 60 | 2.89 | 87 | 0.6688 | 2,949 |

| Competitor A | 20 | 3.20 | 32 | 0.4135 | 2,587 |

| Competitor B | 30 | 3.20 | 48 | 0.6841 | 2,935 |

| Brand X | 62 | 2.43 | 75 | 0.5616 | 2,866 |

| Brand Y | 30 | 2.86 | 43 | 0.5309 | 2,583 |

| Brand Z | 30 | 2.75 | 41 | 0.6228 | 2,689 |

| AIG | 30 | 3.41 | 51 | 0.5054 | 2,292 |

GSR Correlation with Self-Report:

| Vhi | Quote Devil | Booking | Mainstreet realtor | Tetley | AIG | |

|---|---|---|---|---|---|---|

| GSR Peaks p/min | 2 | 3 | 6 | 4 | 5 | 1 |

| Implicit Pref. | 3 | 5 | 1 | 6 | 2 | 4 |

| Unaided Recall | 3 | 5 | 4 | 6 | 2 | 1 |

| 1st Pref. Recall | 3 | 4 | 5 | 6 | 2 | 1 |

| Aided Recall | 4 | 2 | 1 | 6 | 5 | 3 |

| Purchase Prop. | 2 | 5 | 1 | 6 | 4 | 3 |

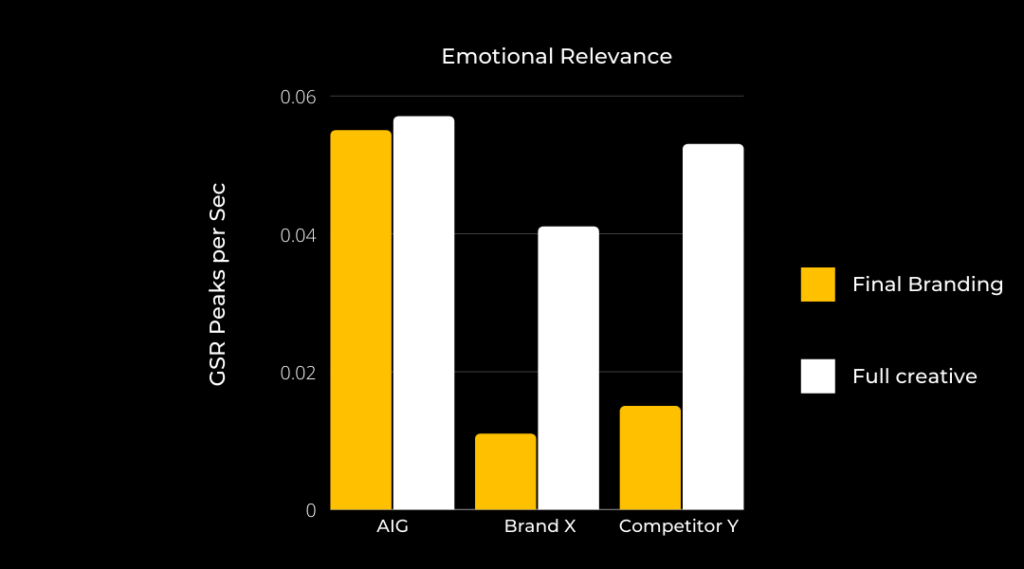

No Peaks at Brand Reveal

- Relative to many of the comparative creatives in question, the final branding moment performed strongly, outperforming the comparative creatives. However, the Final Branding moment does not contain a discernible emotional peak. which leaves room for improvement.

- The GSR Peaks p/sec performance for the final branding scene (10 Seconds) is almost identical to the GSR peaks per second score for the entire video, which means that there was no standout moment for the viewer to subconsciously latch onto and form brand associations.

- However, this is not completely negative as by comparison, the AIG final branding moment strongly outperforms the comparative creatives (Brand X & Competitor A in the image shown below) is at minimum 300% more emotive than the 2 comparative creatives chosen for the basis of this analysis.

- To drive impact and association with the viewer we want to present the Branding / Product as part of the emotional journey, ultimately enabling viewers to associate your brand with the given emotion.

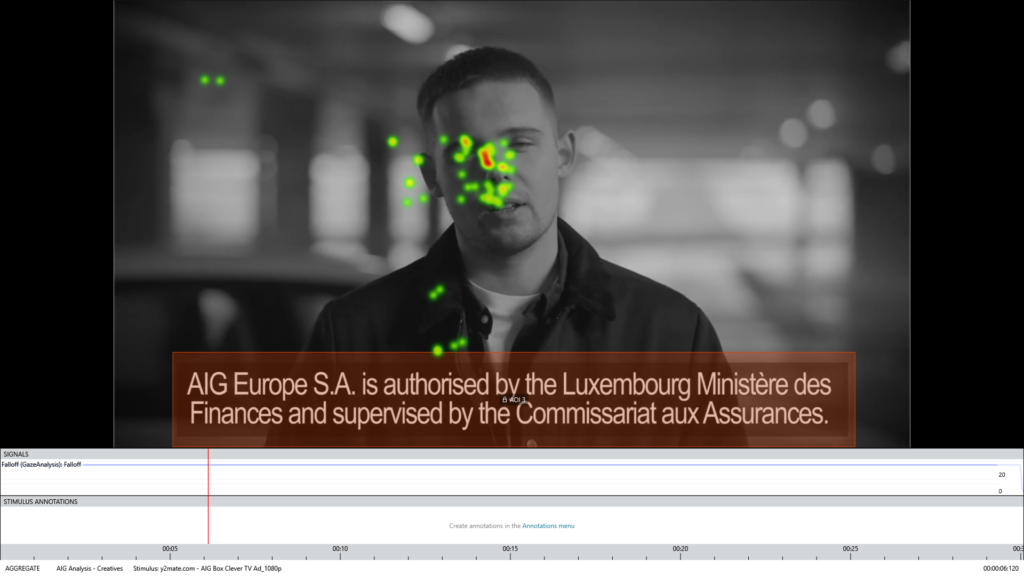

Minimalist Design Holds Attention

The minimalist design of the creative results in a decreased cognitive load & effort on the viewer:

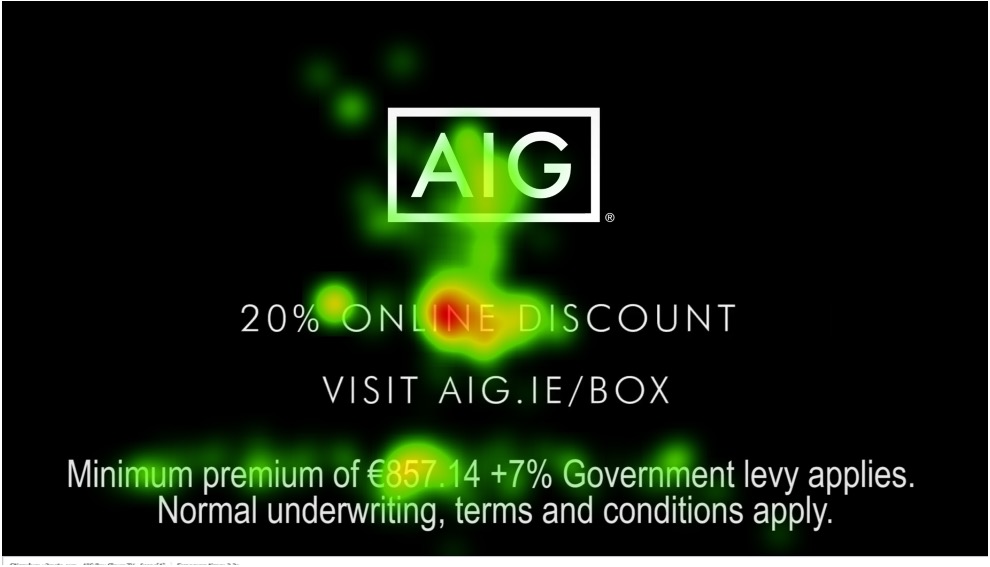

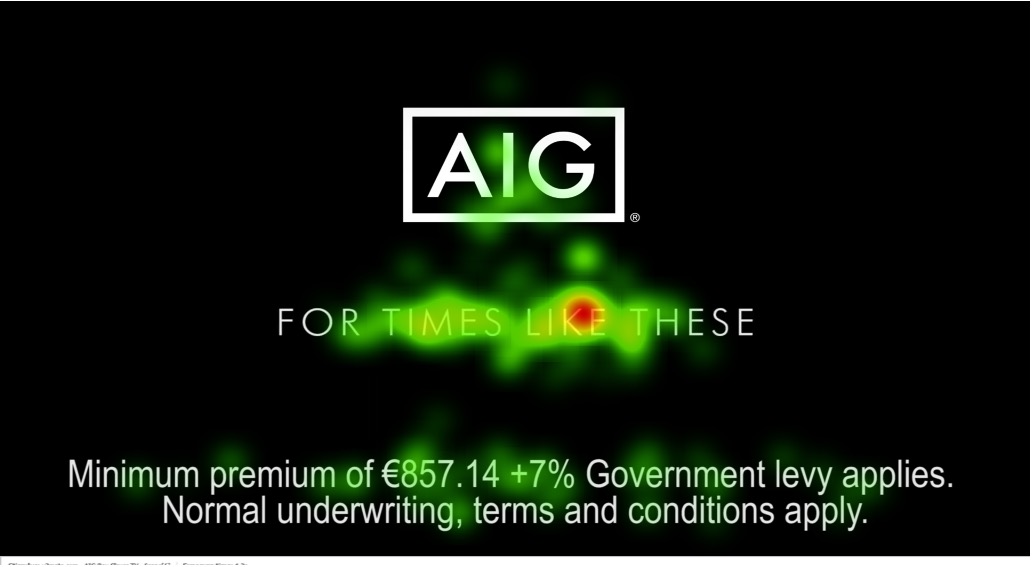

The images shown to the right are freeze frames taken from the aggregated gaze map (i.e. the combined gaze tracking for all respondents for the video).

The consistent theme throughout the exposure is a constant facial bias (i.e. as humans we are subconsciously drawn to view people’s faces). In this situation, the actor is the vehicle for conveying the messaging, which ensures increased attentiveness towards the messaging.

- The simplicity and directiveness of the creative allows for added focus on the face which enables heightened attention to the message being delivered by the actors.

- This attentiveness was not emotionally stimulated, rather it is the by-product of human-beings being subconsciously attracted to faces particularly when that person is speaking.

- The creative choices made in the ad allowed for little distraction, the blurred background with in-focus actor, the lack of audio and minimal use of colour further reinforces the viewers’ complete focus on the actor as the message is conveyed without interruption or compromise.

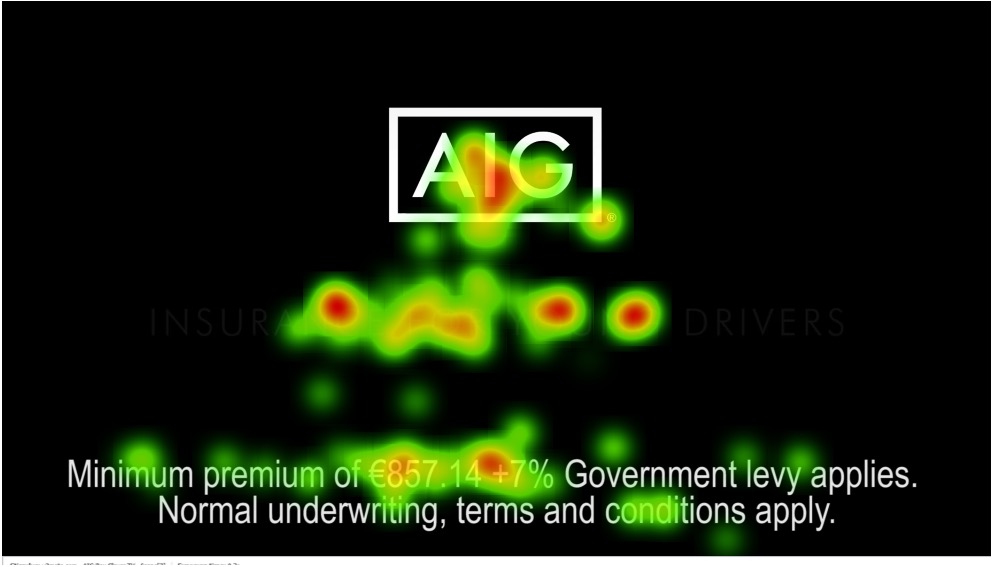

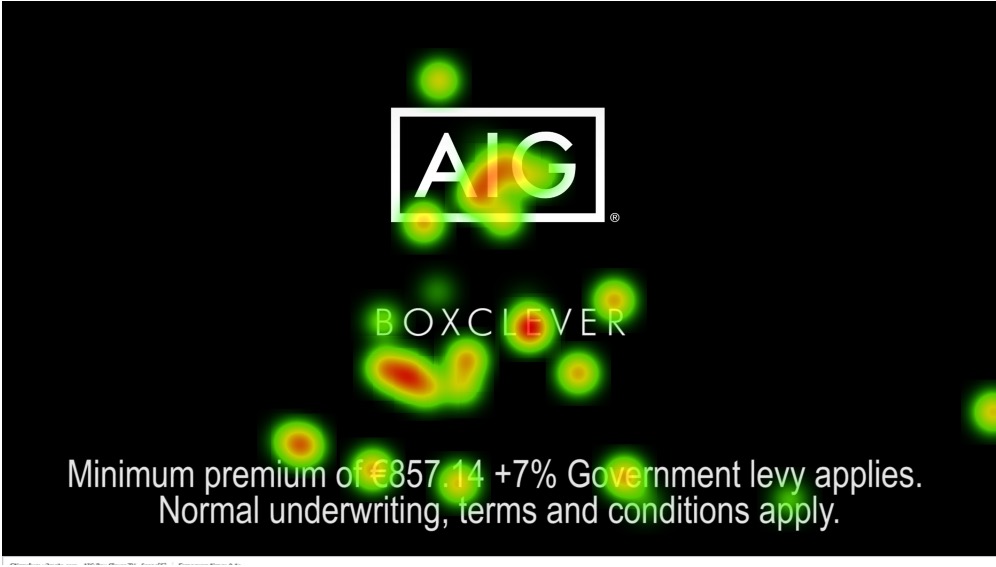

Paralysis By Analysis

Competing Brand, Product & Messaging:

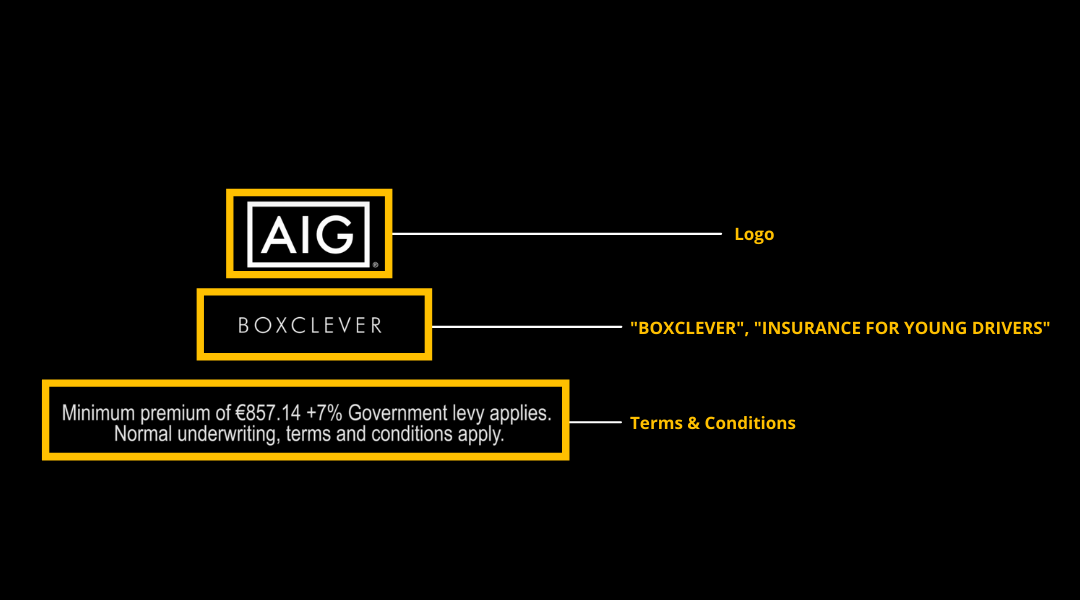

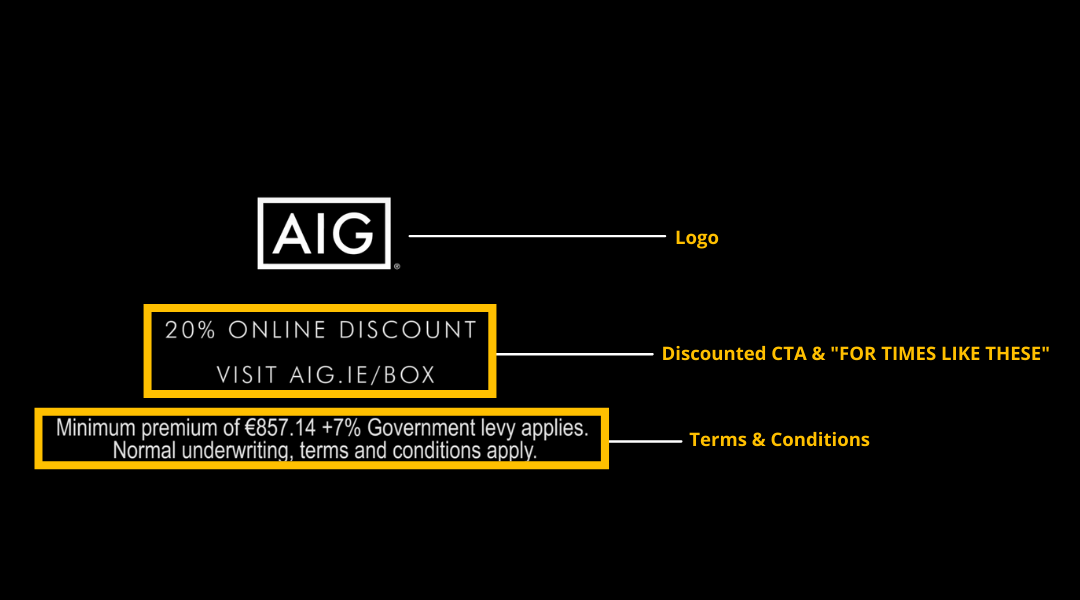

While the AIG BoxClever closing screen performs strongly from an aggregated perspective when compared with its competitors when you dig down into the details it appears as though the Brand, Product & associated messaging are competing with one another from an attention standpoint.

- From the perspective of attention, we as human beings are unable to apply our attention & intent to two things at the same time.

- When objects change rapidly or compete with one another, this can cause inattentive blindness, or in other words, the viewer tunes out and default to central screen bias. They do not know what’s happening so the mind places your vision at the point where you can absorb as much information as possible (i.e., the centre of the screen)

- Competing elements divide attention resulting in a reduced dwell time which means the viewer applies a reduced amount of cognitive processing towards the area of interest, diminishing its effectiveness for recall.

Areas of Interest Analysis

The minimalist nature of the creative allowed for all elements to be at least seen by more than 70% of respondents. However, there was a diminishing level of attentiveness towards key Areas of Interest at the end of the creative, this is an effect of having a 10-second long end card after the creative.

This can be seen in the % to Notice of the table to the right shows that the Logo, T’s & C’s and BoxClever product plug were fixated on by the entire panel of respondents. However, the later elements such as the two taglines & the discounted CTA show a notable diminishing performance over the course of the exposure. This can be attributed to the audience tuning out of the creative as they have lost interest in the 10-second long end card.

AIG Areas of Interest Report:

| AIG Areas of Interest | AOI Total Dur (sec) | % to Notice | Time to First Fixation (sec) | Gaze Sequence./ | Avg. Revisit Count | Time Spent (ms) | Time Spent (sec) | Time Spent (%) | Avg. Fixation Duration |

|---|---|---|---|---|---|---|---|---|---|

| Logo | 10.45 | 96.77 | 0.61 | 2 | 2.73 | 1.699.89 | 1.70 | 16.27 | 266.94 |

| BoxClever | 1.97 | 96.77 | 0.27 | 3 | 0.63 | 815.68 | 0.82 | 41.32 | 302.49 |

| “Insurance for young drivers” | 1.93 | 80.65 | 0.23 | 4 | 0.19 | 1038.67 | 1.04 | 53.84 | 294.60 |

| Discounted CTA | 4.21 | 93.55 | 0.32 | 5 | 1.38 | 2207.55 | 2.21 | 52.49 | 323.61 |

| “For times like these” | 1.59 | 77.42 | 0.20 | 6 | 0.46 | 922.28 | 0.92 | 58.18 | 287.27 |

| Terms & Conditions | 30.03 | 100.00 | 1.66 | 1 | 6.23 | 5715.51 | 5.72 | 19.03 | 189.87 |

The terms & conditions were analysed individually to understand how the audience interacted with the footer across the duration of the creative. While all viewers fixated on the Ts & C’s at least once, the average fixation duration (0.1 sec) indicates that viewer’s do not take time to read the contents of the T’s & C’s.

Uncovering Rational Thought

Self-Reported Outcomes:

To determine the impact of the creative from the perspective of initial impressions of the creative, impact on memorability / recall and purchase intent across the body of respondents, we posed several self-reported tasks as part of the study experience.

Results:

In summary, the AIG BoxClever creative performed strongly from the perspective of Recall & Purchase likelihood in spite of the fact that respondent’s demonstrated a slight preference towards the creative as opposed to those who did not enjoy it.

Unaided Recall:

61% of respondents were able to recall the AIG brand post-exposure, the top result of all brands displayed. In addition, AIG was the first preference for 23% of respondents when prompted for unaided recall.

Speed-to-Response:

The average speed to response for the AIG BoxClever ad was 4.13 sec, this is 6% ahead of the average across all advertisements indicating that there was no specific pattern / presence of implicit preference towards positive / negative responses for the AIG BoxClever Advertisement.

Self-Reported Preference:

58% of respondents reported to have enjoyed the AIG BoxClever advertisement.

Purchase Propensity:

54% of respondents reported that they would be likely to purchase Young Driver’s Insurance from AIG having viewed the advertisement.