BACKGROUND

AIG were launching their Accident & Health (A&H) portfolio in the Irish market, a product that has historically been a function of direct sales channels, but moving towards more scalable digital sales channels was a strategic objective for AIG globally. As such, AIG Ireland were selected as a test market and challenged to try something different.

THE PROBLEM

Launching Accident & Health products presented a variety of challenges:

- Diverse Products: A&H products meet different needs for different people (e.g. Cancer Care vs. Personal Accident Insurance)

- Product Awareness: There is a limited awareness for the existence of these product types in Ireland.

- Globally Challenging: The global shift to digital channels for A&H has proved challenging across the globe

- Appetite / Understanding: People don’t wake up in the morning seeking A&H cover.

- Product Differentiation: Difficult to differentiate A&H from traditional health insurance which caused market confusion.

- Perceived Lack of Need: Potential customers saw these products as something that may be nice to have but not necessarily something they need.

To tackle these challenges, AIG needed to develop a comprehensive campaign that was backed by extensive research & actionable insights. Providing them with confidence that consumers were receiving a consistent brand experience across their marketing mix.

WHAT WE DID

Neuro Product Concept Testing

Firstly, we needed to understand what level of interest & appetite there was within the identified segments towards the A&H products.

We achieved this by measuring both the physiological arousal (GSR) & subconscious preference (Frontal Asymmetry – EEG) of respondents towards AIG A&H products by randomly exposing respondents to the A&H products themselves and a competitive set.

Results: By identifying the concepts that triggered the optimal Conscious & Subconscious response, we were able to confirm & validate the appetite of the target segments towards each of the A&H concepts vs. the competitive set.

Neuro Name Testing

It can be difficult to stay objective when going through the naming process, however opinion is often very important element in the process. As such it was important for us to combine the conscious opinion with the subconscious indicators for preference, as there are factors that can only be accounted for when one’s logic is accounted for.

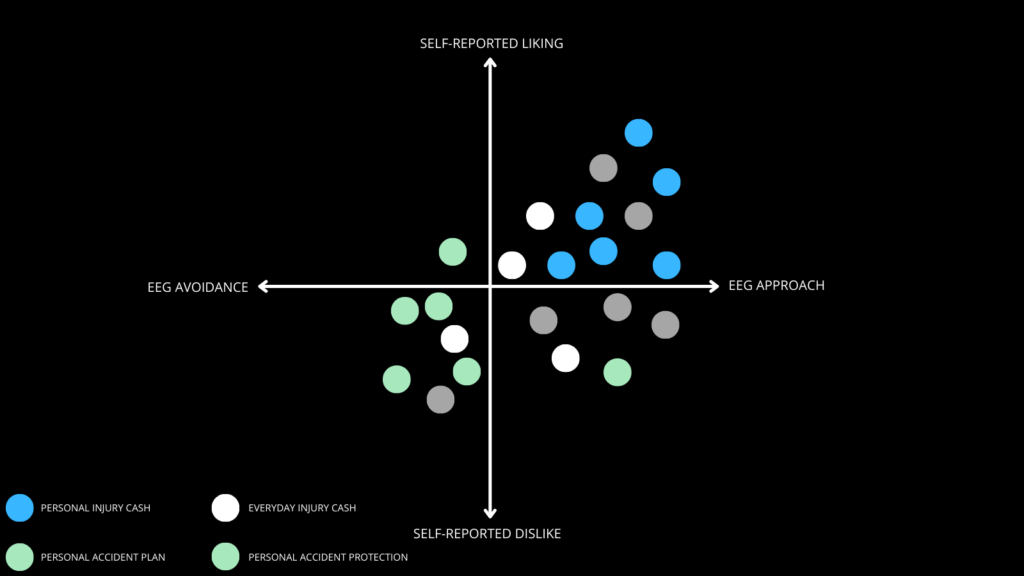

Results: We created a ‘circumplex’ (x,y axis shown above) by plotting the subconscious preference, measured through EEG on the x-axis, against the self-reported preference, on the y-axis. In doing so, we were able to determine the ideal naming convention that factored in the conscious, logical aspects of the naming process alongside the automatic human preference.

Neuro Price Testing

Off-Putting or Aversive prices trigger similar brain patterns to physical pain (i.e. the pain of purchase). Our subconscious processing of an ‘offer’ is fundamentally based in relativity. Our ‘perceived fairness’ of a deal is evaluated against an ‘Anchor’ or reference point that frames our processing. As opposed to a conscious evaluation of the utility vs. price.

‘Predicted Value’ impacts experience, if we enter with an expectation of price and the experience violates that expectation, we automatically update our mental model and reassess our stored predicted value for future experiences, either positively / negatively. Meaning the pricing have a genuine impact in changing consumer perceptions of the brand itself.

Results: We determined the optimal pricing point for the various products, and by evaluating the subconscious response of consumers towards the prices & framing effects presented (e.g. Bundles, Packages & Offers etc.) we qualified the most stimulating and positively motivating pricing & package for each product line.

Emotional Triggers

A shortcut to capture & hold attention, affect memory, and trigger behaviours is through the use of emotion. But firstly, you need to understand what emotional triggers resonate most effectively with consumers for across the product lines and audience segments.

To achieve this, we recruited actors to deliver specific scripts centred around various emotional triggers such as humour, loss aversion, comfort/peace of mind, sadness/sorrow, and inspiration as well as some ‘literal content’ that removed the human element (i.e., infographic and explainer videos).

By identifying and quantifying the most impactful emotional responses, we were able to provide guidance for the creative team to help them develop the campaign creative assets that would underpin the entire communications efforts to ensure that they stay true to the identified emotional triggers at all campaign interactions.

RESEARCH OUTPUTS

- Market Understanding: Insights into the Market Size, Awareness, Competition And Purchasing Habits of consumers within the Insurance space was generated using quantitative methods.

- Audience Definition: Identified the Market, Segments & Indicators for their Demographic, Interest & Behaviour Patterns.

- Product Appetite: Measured the Arousal & Preference towards the concept of these products to validate whether or not an Irish audience were receptive to the products which all returned largely positive.

- Product Names: The rational self-reported preference of all respondents was plotted against the biometric analysis of the brand using EEG to plot the conscious stated preference towards the naming concepts presented & the subconscious preference demonstrated in the mind through the Pre-Frontal Asymmetry score.

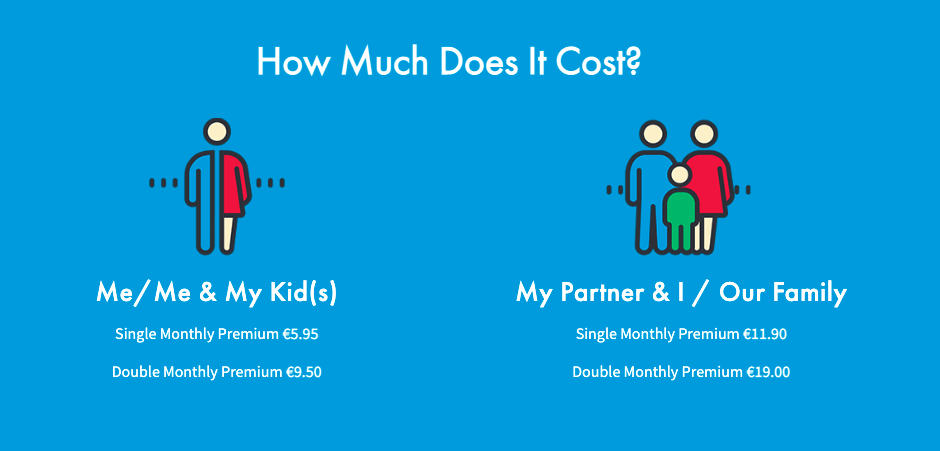

- Product Price: The changes in skin conductance (GSR) and brain activity (EEG) were used to produce the below circumplex that allowed us to precisely pinpoint the optimal price for the products in question. Interestingly the lowest price presented triggered negative connotations which was later validated qualitatively to be due to suspicion at the value on offer. Ultimately €5.95 was the highest performing price point and the price selected for the launch.

- Emotional Triggers: Determined the specific emotional triggers that generated the most effective performance from the perspective of Attention, Emotion, Cognition & Preference. These emotional triggers informed the creative process & the development of campaign assets.

- Creative Evaluation & Effectiveness: Evaluation of the campaign collateral to ensure that they are triggering the desired Emotional Response & whilst achieving desired levels of attention for their intended placements & formats (i.e. Social, YouTube, Website etc.)

BUSINESS OUTCOMES

We were able to use the insights we learned and turn them into actionable outcomes by effectively taking the A&H product range to market.

This resulted in increased awareness, web traffic was up +1047% and cross-channel engagements on social media were up +133%. Resulted in increased interest with A&H product quotations increased by +413% as a direct result of the campaign. Conversions showed positive uptake with product sales increased by 198%. The A&H product was recognised as the number one performing digital subsidiary in Europe based on the results of the campaign.

Brand performance in health insurance category increased by +18%, with customer retention being improved by +4% and an also an increase of +192% in year on year new customers.